Page 202 - Pages from Main Additional Emails Updated

P. 202

Return Premiums & Cancellation Charges

Return premiums usually arise if an insurance risk is reduced or a policy cancelled.

In the event of cancellation by consumers insurers may return a pro-rata premium to us based on the time on risk.

In the event of cancellation by commercial customers insurers may return a premium as follows:

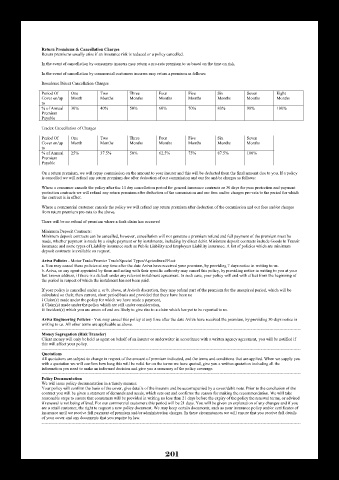

Broadsure Direct Cancellation Charges

Period Of One Two Three Four Five Six Seven Eight

Cover on/up Month Months Months Months Months Months Months Months

to

% of Annual 30% 40% 50% 60% 70% 80% 90% 100%

Premium

Payable

Tradex Cancellation of Charges

Period Of One Two Three Four Five Six Seven

Cover on/up Month Months Months Months Months Months Months

to

% of Annual 25% 37.5% 50% 62.5% 75% 87.5% 100%

Premium

Payable

On a return premium, we will repay commission on the amount to your insurer and this will be deducted from the final amount due to you. If a policy

is cancelled we will refund any return premium due after deduction of our commission and our fee and/or charges as follows:

Where a consumer cancels the policy after the 14 day cancellation period for general insurance contracts or 30 days for pure protection and payment

protection contracts we will refund any return premium after deduction of the commission and our fees and/or charges pro-rata to the period for which

the contract is in effect.

Where a commercial customer cancels the policy we will refund any return premium after deduction of the commission and our fees and/or charges

from return premium pro-rata to the above.

There will be no refund of premium where a fault claim has occurred

Minimum Deposit Contracts:

Minimum deposit contracts can be cancelled, however, cancellation will not generate a premium refund and full payment of the premium must be

made, whether payment is made by a single payment or by instalments, including by direct debit. Minimum deposit contracts include Goods In Transit

insurance and some types of Liability insurance such as Public Liability and Employers Liability insurance. A list of policies which are minimum

deposit contracts is available on request.

Aviva Policies - Motor Trade/Premier Truck/Special Types/Agricultural/Fleet

a. You may cancel these policies at any time after the date Aviva have received your premium, by providing 7 days notice in writing to us.

b. Aviva, or any agent appointed by them and acting with their specific authority may cancel this policy, by providing notice in writing to you at your

last known address, if there is a default under any relevant instalment agreement. In such case, your policy will end with effect from the beginning of

the period in respect of which the instalment has not been paid.

If your policy is cancelled under a. or b. above, at Aviva's discretion, they may refund part of the premium for the unexpired period, which will be

calculated on their, then current, short period basis and provided that there have been no

i Claim(s) made under the policy for which we have made a payment,

ii Claim(s) made under the policy which are still under consideration,

iii Incident(s) which you are aware of and are likely to give rise to a claim which has yet to be reported to us.

Aviva Engineering Policies - You may cancel this policy at any time after the date Aviva have received the premium, by providing 30 days notice in

writing to us. All other terms are applicable as above.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Money Segregation (Risk Transfer)

Client money will only be held as agent on behalf of an insurer or underwriter in accordance with a written agency agreement, you will be notified if

this will affect your policy.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Quotations

All quotations are subject to change in respect of the amount of premium indicated, and the terms and conditions that are applied. When we supply you

with a quotation we will confirm how long this will be valid for on the terms we have quoted, give you a written quotation including all the

information you need to make an informed decision and give you a summary of the policy coverage.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Policy Documentation

We will issue policy documentation in a timely manner.

Your policy will confirm the basis of the cover, give details of the insurers and be accomapanied by a cover/debit note. Prior to the conclusion of the

contract you will be given a statment of demands and needs, which sets out and confirms the reason for making the recommendation. We will take

reasonable steps to ensure that consumers will be provided in writing no less than 21 days before the expiry of the policy the renewal terms, or advised

if renewal is not being offered. For our commercial customers this period will be 21 days. You will be given an explanation of any changes and if you

are a retail customer, the right to request a new policy document. We may keep certain documents, such as your insurance policy and/or certificates of

insurance until we receive full payment of premium and/or administration charges. In these circumstances we will ensure that you receive full details

of your cover and any documents that you require by law.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

201