Page 80 - 2. 2013 New 26-05-21 No Table

P. 80

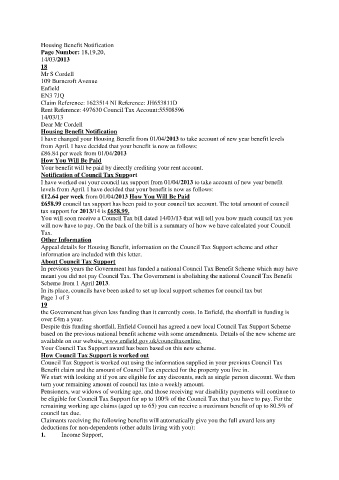

Housing Benefit Notification

Page Number: 18,19,20,

14/03/2013

18

Mr S Cordell

109 Burncroft Avenue

Enfield

EN3 7JQ

Claim Reference: 1623514 NI Reference: JH653811D

Rent Reference: 497630 Council Tax Account:55508596

14/03/13

Dear Mr Cordell

Housing Benefit Notification

I have changed your Housing Benefit from 01/04/2013 to take account of new year benefit levels

from April. I have decided that your benefit is now as follows:

£86.84 per week from 01/04/2013

How You Will Be Paid

Your benefit will be paid by directly crediting your rent account.

Notification of Council Tax Support

I have worked out your council tax support from 01/04/2013 to take account of new year benefit

levels from April. I have decided that your benefit is now as follows:

£12.64 per week from 01/04/2013 How You Will Be Paid

£658.99 council tax support has been paid to your council tax account. The total amount of council

tax support for 2013/14 is £658.99.

You will soon receive a Council Tax bill dated 14/03/13 that will tell you how much council tax you

will now have to pay. On the back of the bill is a summary of how we have calculated your Council

Tax.

Other Information

Appeal details for Housing Benefit, information on the Council Tax Support scheme and other

information are included with this letter.

About Council Tax Support

In previous years the Government has funded a national Council Tax Benefit Scheme which may have

meant you did not pay Council Tax. The Government is abolishing the national Council Tax Benefit

Scheme from 1 April 2013.

In its place, councils have been asked to set up local support schemes for council tax but

Page 1 of 3

19

the Government has given less funding than it currently costs. In Enfield, the shortfall in funding is

over £4m a year.

Despite this funding shortfall, Enfield Council has agreed a new local Council Tax Support Scheme

based on the previous national benefit scheme with some amendments. Details of the new scheme are

available on our website, www.enfield.gov.uk/counciltaxonline.

Your Council Tax Support award has been based on this new scheme.

How Council Tax Support is worked out

Council Tax Support is worked out using the information supplied in your previous Council Tax

Benefit claim and the amount of Council Tax expected for the property you live in.

We start with looking at if you are eligible for any discounts, such as single person discount. We then

turn your remaining amount of council tax into a weekly amount.

Pensioners, war widows of working age, and those receiving war disability payments will continue to

be eligible for Council Tax Support for up to 100% of the Council Tax that you have to pay. For the

remaining working age claims (aged up to 65) you can receive a maximum benefit of up to 80.5% of

council tax due.

Claimants receiving the following benefits will automatically give you the full award less any

deductions for non-dependents (other adults living with you):

1. Income Support,